- Understanding the Importance of Teenage Finance

- Developing Essential Money Management Skills

- Setting Financial Goals for Teenagers

- Budgeting Tips for Teenagers

- Earning and Saving Money as a Teen

- Earning Money

- Saving Money

- Financial Education

- Making Smart Spending Decisions

Understanding the Importance of Teenage Finance

Teenage Finance: The Basics of Money Management

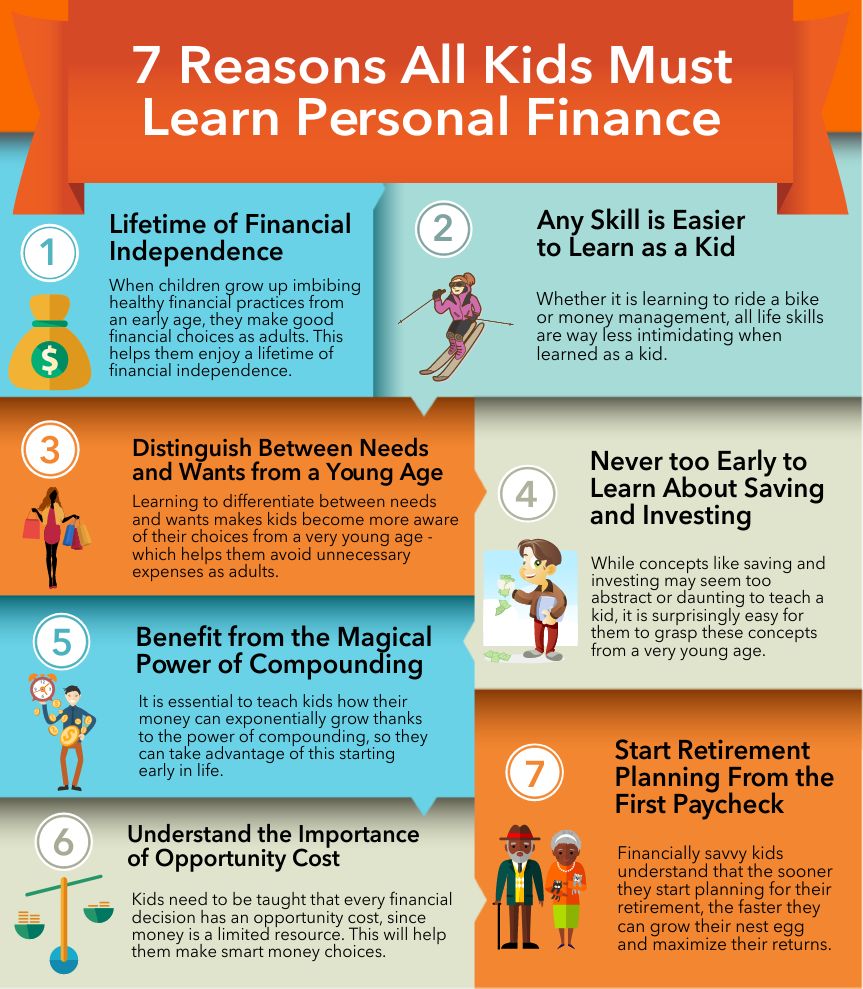

Money management is an essential skill that every individual, including teenagers, should learn. Understanding personal finance at a young age can have a profound impact on one’s financial well-being in the future. In this section, we will delve into the importance of teenage finance and why it is crucial for teenagers to develop good money management habits.

1. Building a strong foundation:

Learning about finance during the teenage years lays a solid foundation for a secure financial future. It equips teenagers with the knowledge and skills necessary to handle money responsibly. By understanding concepts such as budgeting, saving, and investing, teenagers can make informed decisions about their personal finances.

2. Developing financial responsibility:

Teenagers who are knowledgeable about finance are more likely to develop a sense of financial responsibility. They understand the value of money and the importance of making wise financial choices. This includes distinguishing between needs and wants, setting financial goals, and making informed purchasing decisions.

3. Avoiding debt and financial pitfalls:

One of the biggest advantages of understanding teenage finance is the ability to avoid falling into debt and financial pitfalls. By learning about concepts like interest rates, credit cards, and loans, teenagers can make informed decisions that prevent them from accumulating unnecessary debt. This knowledge empowers them to live within their means and make responsible financial choices.

4. Building long-term wealth:

The earlier teenagers start managing their finances, the better positioned they are to build long-term wealth. By saving and investing at a young age, they can take advantage of compound interest and reap the benefits of long-term financial growth. Understanding the power of saving and investing can set teenagers on a path toward financial independence and stability later in life.

5. Developing good financial habits:

Developing good financial habits early on can lead to a lifetime of financial success. Teenagers who learn to budget, save, and invest are more likely to continue these habits into adulthood. By mastering these skills at a young age, teenagers can develop a level of financial discipline that will serve them well throughout their lives.

In conclusion, understanding teenage finance is of utmost importance for teenagers to develop good money management skills. It sets the stage for a financially secure future and empowers teenagers to make informed decisions about their personal finances. By building a strong foundation, developing financial responsibility, avoiding debt, building long-term wealth, and developing good financial habits, teenagers can take control of their financial well-being and set themselves up for a successful financial future.

Developing Essential Money Management Skills

Developing Essential Money Management Skills

Money management is a crucial skill that teenagers should start developing early on. Learning how to effectively manage personal finances not only sets them up for a successful future but also helps them make informed decisions about saving, spending, and investing. In this section, we will explore some essential money management skills that every teenager should learn.

1. Budgeting: Creating a budget is a fundamental skill in money management. It involves tracking income and expenses to ensure that spending aligns with financial goals. Start by listing all sources of income, such as allowances or part-time jobs. Then, categorize expenses into different areas, such as entertainment, transportation, and savings. By budgeting, teenagers can prioritize their spending, avoid overspending, and save money for future goals.

2. Setting Financial Goals: Encouraging teenagers to set financial goals will help them develop a sense of responsibility and purpose when it comes to managing money. Whether it’s saving for a new gadget, a vacation, or college tuition, setting specific and achievable goals can motivate them to make better financial decisions. By breaking down larger goals into smaller milestones, teenagers can track their progress and stay focused.

3. Saving and Investing: Teaching teenagers the importance of saving and investing early on can have a significant impact on their financial well-being in the long run. Encourage them to set aside a portion of their income regularly for emergencies and future expenses. Furthermore, introducing them to the concept of investing and the power of compound interest can help them grow their savings over time.

4. Differentiating Wants from Needs: It’s essential for teenagers to understand the difference between wants and needs. In a world filled with advertisements and peer pressure, distinguishing between the two can help them make wise spending choices. Encourage them to evaluate whether a purchase is necessary or if it is just something they desire in the moment. This skill will enable them to prioritize their spending and avoid unnecessary debt.

5. Responsible Credit Card Usage: Credit cards can be powerful financial tools if used responsibly. However, it is crucial to teach teenagers about the potential risks and consequences of misusing credit. Explain the importance of paying bills on time, avoiding excessive debt, and understanding interest rates. By instilling responsible credit card habits early on, teenagers can build a solid foundation for their future financial endeavors.

6. Tracking and Reviewing Finances: Regularly reviewing and tracking personal finances is an essential habit for teenagers to develop. Encourage them to keep track of their income, expenses, and savings. This practice not only helps them stay organized but also enables them to identify areas where they can cut costs or save more money. By reviewing their finances periodically, they can make adjustments and ensure they are on track to meet their financial goals.

In conclusion, developing essential money management skills is crucial for teenagers to lay a strong foundation for their personal finance journey. By mastering skills such as budgeting, setting financial goals, saving and investing, differentiating wants from needs, responsible credit card usage, and tracking their finances, teenagers can become financially responsible individuals who are well-prepared for the future.

Setting Financial Goals for Teenagers

Teenage Finance: The Basics of Money Management

As teenagers, it’s never too early to start developing good financial habits. Learning how to manage money at a young age can set you up for a lifetime of financial success. One important aspect of money management is setting financial goals. By setting goals, you can not only track your progress but also stay motivated and focused on achieving your aspirations. In this section, we will explore how teenagers can effectively set financial goals and work towards achieving them.

1. Start with short-term goals:

– Short-term goals are those that you can achieve within a few weeks or months. They are a great way to build momentum and gain confidence in your ability to manage money. Examples of short-term goals may include saving up for a new gadget or a concert ticket.

– To set short-term goals, think about what you want to achieve in the near future and how much money you will need. Break down the goal into smaller, manageable steps, and determine a timeframe for accomplishing each step.

2. Set long-term goals:

– Long-term goals are those that may take a year or more to accomplish. These goals require more planning and commitment but can have a significant impact on your financial future. Examples of long-term goals may include saving for college or a down payment on a house.

– When setting long-term goals, consider your aspirations and what you want to achieve in the future. Determine how much money you will need and create a timeline for reaching your goal. Break down the goal into smaller milestones to track your progress along the way.

3. Make your goals specific and measurable:

– It’s important to make your financial goals specific and measurable. Instead of saying, “I want to save money,” specify the amount you want to save and by when. For example, “I want to save $500 by the end of the summer.”

– By making your goals specific and measurable, you can track your progress and know when you have successfully achieved them. This will also help you stay focused and motivated throughout your financial journey.

4. Create a budget:

– A budget is a crucial tool for managing your money effectively. It helps you allocate your income towards different expenses and savings goals. Creating a budget will enable you to track your income and expenses, identify areas where you can cut back, and ensure that you are saving enough to reach your financial goals.

– Start by listing all your sources of income and your regular expenses. Allocate a portion of your income towards savings and prioritize your financial goals within your budget. Regularly review and adjust your budget as needed to stay on track.

5. Stay disciplined and stay on track:

– Setting financial goals is just the first step; staying disciplined and committed to achieving them is equally important. It may require making sacrifices and saying no to impulse purchases. Remember the long-term benefits and stay focused on your goals.

– Regularly review your progress, celebrate small victories, and make adjustments if necessary. Stay motivated by visualizing the rewards of achieving your goals and remind yourself of the financial freedom and security you are working towards.

Setting financial goals as a teenager is an excellent way to develop good money management skills and lay a strong foundation for your future. By starting early and staying committed, you can achieve your financial aspirations and set yourself up for a lifetime of financial success. So, take control of your personal finance today and start setting goals that will lead you to a prosperous future.

Budgeting Tips for Teenagers

Teenage Finance: The Basics of Money Management

Budgeting Tips for Teenagers

Managing money effectively is an essential skill that teenagers should learn early on. By developing good budgeting habits, teenagers can set themselves up for a financially secure future. Here are some budgeting tips specifically designed for teenagers to help them navigate the world of personal finance.

1. Set Financial Goals: Start by setting short-term and long-term financial goals. Whether it’s saving up for a new gadget or setting aside money for college, having clear goals will give you direction and motivation.

2. Track Your Expenses: Keep track of your expenses by creating a budget spreadsheet or using budgeting apps. Monitor your spending habits, categorize your expenses, and identify areas where you can cut back to save more.

3. Differentiate Wants from Needs: Learn to distinguish between wants and needs. Wants are things that you desire but are not essential, while needs are necessary for survival. Prioritize your needs, and be mindful of your wants to avoid overspending.

4. Save Regularly: Make saving a habit by setting aside a portion of your income regularly. Aim to save at least 10-20% of your earnings. Consider opening a savings account to keep your money separate and earn interest over time.

5. Avoid Impulse Buying: Think twice before making impulse purchases. Take a pause and ask yourself if it’s something you truly need or if it’s just a fleeting desire. Delaying gratification can help you make wiser financial decisions.

6. Plan for Emergencies: Unexpected expenses can arise at any time, so it’s crucial to have an emergency fund. Set aside a portion of your savings specifically for emergencies to avoid dipping into your regular savings.

7. Earn and Manage Your Income: Find ways to earn money, such as taking on part-time jobs, freelancing, or starting a small business. Once you have income, manage it wisely. Create a system to keep track of your earnings, expenses, and savings.

8. Avoid Debt: Be cautious about taking on unnecessary debt, such as credit card debt or loans. Understand the consequences of borrowing money and the importance of paying it back on time to avoid high-interest charges and damaging your credit score.

9. Learn About Investing: Educate yourself about investing and its potential benefits. While it may seem intimidating at first, starting early and understanding basic investment concepts can help you grow your wealth in the long run.

10. Seek Financial Education: Take advantage of resources available to learn more about personal finance. Attend workshops, read books or articles, and follow reputable financial experts to enhance your knowledge and skills.

By implementing these budgeting tips, teenagers can develop strong money management skills and lay the foundation for a financially stable future. Remember, financial success is a journey that requires discipline, patience, and continuous learning.

Earning and Saving Money as a Teen

When it comes to money management, teenagers often find themselves facing new challenges and responsibilities. Earning and saving money as a teen is an important part of personal finance and can set the foundation for a lifetime of financial success. In this section, we will explore some practical tips and strategies for teenagers to effectively manage their finances.

Earning Money

One of the first steps in teenage finance is finding opportunities to earn money. While traditional part-time jobs may be limited for younger teens, there are still various ways to make some extra cash:

- Offering to do household chores or help neighbors with tasks

- Babysitting for families in your community

- Starting a small business, such as dog walking or tutoring

- Exploring online platforms that offer freelance work for teens

By being proactive and resourceful, teenagers can find ways to earn money that fit their skills and interests.

Saving Money

Once you start earning money, it’s important to develop good saving habits. Saving allows you to build a financial cushion and work towards your long-term goals. Here are some tips for saving money as a teenager:

- Create a budget: Keep track of your income and expenses to understand where your money is going.

- Set savings goals: Identify what you are saving for, whether it’s a new gadget, college tuition, or a future trip.

- Automate savings: Consider setting up automatic transfers to a savings account to make saving a regular habit.

- Be mindful of spending: Think twice before making impulse purchases and prioritize your needs over wants.

- Look for discounts and deals: Take advantage of student discounts and coupons to stretch your money further.

By implementing these saving strategies, teenagers can start building a strong foundation for their financial future.

Financial Education

Lastly, it’s crucial for teenagers to invest in their financial education. Learning about personal finance can help teens make informed decisions and develop healthy money habits. Consider the following resources:

- Books and online resources: There are numerous books and websites dedicated to teaching personal finance to teenagers.

- Online courses: Take advantage of online courses or workshops that cover topics like budgeting, investing, and saving.

- Seek advice from adults: Reach out to parents, teachers, or mentors who have experience in managing their finances.

By actively seeking knowledge and understanding the principles of personal finance, teenagers can gain the confidence and skills necessary to navigate the complex world of money management.

In conclusion, earning and saving money as a teenager is a valuable learning experience. By exploring different ways to earn money, developing saving habits, and investing in financial education, teenagers can establish a solid foundation for their future financial success. Remember, it’s never too early to start practicing good money management skills!

Making Smart Spending Decisions

Teenage Finance: The Basics of Money Management

When it comes to money management, teenagers often find themselves facing new and unfamiliar challenges. Learning how to make smart spending decisions is a crucial skill that will benefit them throughout their lives. In this section, we will explore some key strategies that can help teenagers navigate the world of personal finance.

1. Set Financial Goals: One of the first steps in making smart spending decisions is to set clear financial goals. Whether it’s saving for a new gadget, a car, or college tuition, having specific goals in mind can help teenagers prioritize their spending and make informed choices.

2. Create a Budget: A budget is a powerful tool that can assist teenagers in managing their money effectively. By tracking income and expenses, teens can gain a better understanding of where their money is going and identify areas where they can cut back or save. Encourage them to allocate a portion of their income towards savings to build a healthy financial future.

3. Differentiate Between Wants and Needs: It’s easy to get caught up in the allure of the latest trends and impulse purchases. However, teaching teenagers to differentiate between wants and needs is essential for responsible money management. Help them understand that needs, such as food, shelter, and education, should take priority over wants, like entertainment or designer clothing.

4. Research Before Buying: Before making a purchase, teenagers should do their research. With the internet at their fingertips, they can compare prices, read product reviews, and seek out the best deals. Encourage them to be savvy consumers and make informed choices that align with their budget and financial goals.

5. Avoid Impulse Buying: Impulse buying is a common pitfall for many teenagers. Help them develop the habit of pausing and thinking before making a purchase. Encourage them to wait a day or two before buying something they desire impulsively. This waiting period can often lead to a change of mind or the realization that the item is not a necessity.

6. Consider Value for Money: Teenagers should learn to assess the value they will receive from a purchase. Is it something that will provide long-term satisfaction or is it likely to be quickly discarded? Encourage them to think about the longevity and usefulness of an item before spending their hard-earned money.

By following these strategies, teenagers can develop good money management skills and make smart spending decisions. Understanding the importance of setting financial goals, creating a budget, distinguishing between wants and needs, researching purchases, avoiding impulse buying, and considering value for money will empower teenagers to take control of their personal finance and set a solid foundation for their future financial success.

10 Replies to “Teenage Finance: The Basics of Money Management”

I wish someone had taught me about money management when I was a teenager. I made a lot of mistakes and ended up in debt. It’s so important for young people to learn about budgeting, saving, and investing early on.

I started working part-time in high school and had no idea how to handle my income. This article provides great tips on managing money. Can you recommend any specific apps or tools to help track expenses?

As a parent, teaching my teenager about finance is challenging. Any suggestions on how to make money management more engaging and relatable for them? I want to ensure they develop good financial habits.

I wish I had known the importance of saving money when I was younger. It’s incredible how small amounts can grow over time with compound interest. This article highlights the key concepts perfectly!

I started investing in stocks during my teenage years, and it has been a great learning experience. This article provides a solid foundation for young people interested in growing their wealth through investments.

Managing money can be overwhelming for teenagers, especially with the temptation to spend on unnecessary things. It would be helpful to include some real-life examples or case studies in the article.

I believe financial literacy should be part of the school curriculum. Many teenagers enter adulthood without basic money management skills. Do you think schools should take a more active role in teaching finance?

I opened a savings account when I was 16, and it really helped me develop a habit of saving. It would be great if the article discussed different types of bank accounts suitable for teenagers.

Teenagers often rely on their parents for financial support, but it’s crucial for them to learn independence. The tips shared in this article will empower young people to become financially responsible.

I wish I had understood the concept of budgeting earlier in life. It’s amazing how tracking expenses and setting financial goals can positively impact one’s financial well-being. Thank you for this informative article!