- Understanding the Importance of Budgeting

- Setting Financial Goals for Teenagers

- Creating a Budgeting Plan

- Tracking Income and Expenses

- Making Smart Spending Choices

- Saving and Investing for the Future

Understanding the Importance of Budgeting

Understanding the Importance of Budgeting

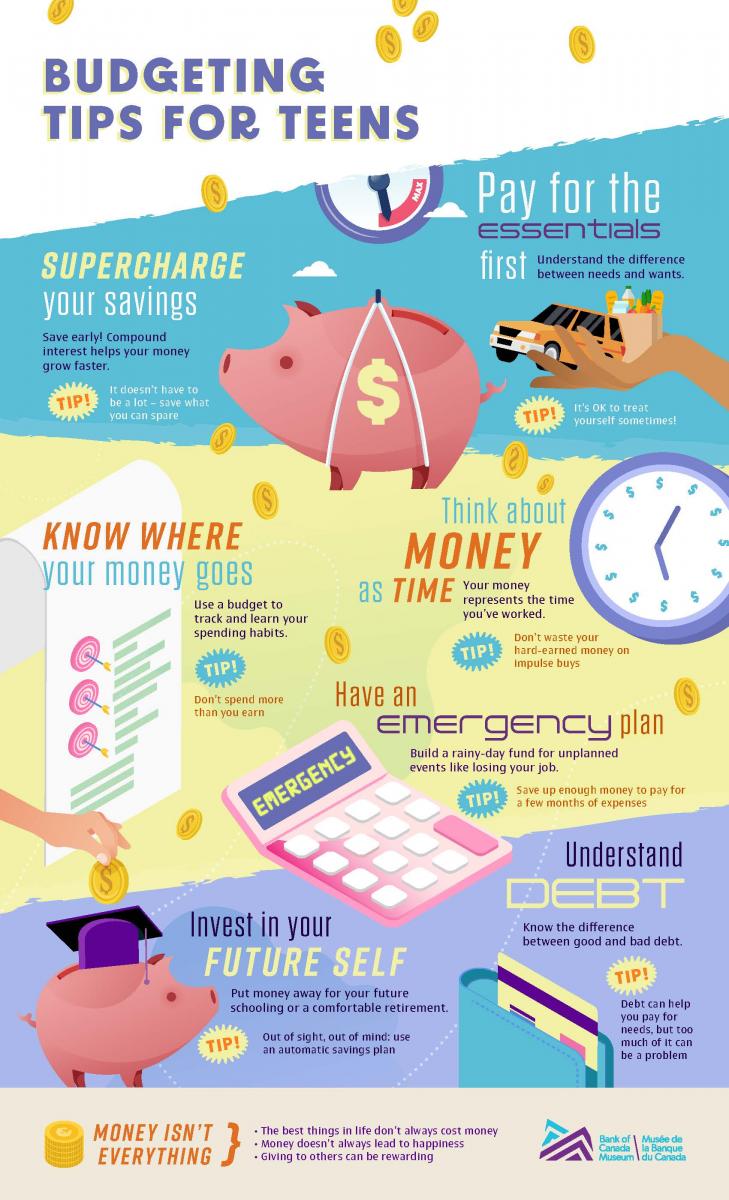

When it comes to managing your money, budgeting is a crucial skill to develop, especially for teenagers. Budgeting involves creating a plan for how you will spend and save your money. It helps you keep track of your income, expenses, and financial goals. By learning how to budget at a young age, you can lay a solid foundation for a lifetime of financial success.

One of the primary reasons why budgeting is important for teenagers is that it promotes financial literacy. Financial literacy refers to having the knowledge and skills to make informed decisions about money. By budgeting, you learn how to prioritize your spending, differentiate between needs and wants, and make responsible choices with your money.

Another benefit of budgeting is that it allows you to take control of your finances. When you have a budget in place, you are less likely to overspend or fall into unnecessary debt. It helps you avoid impulsive purchases and encourages you to save money for future goals, such as buying a car or going to college.

Additionally, budgeting helps you develop good money management habits. It teaches you the importance of setting financial goals, tracking your expenses, and making adjustments when necessary. These skills are essential for building a strong financial future and achieving financial independence.

By budgeting, you also gain a sense of financial security. You know exactly where your money is going and can plan for unexpected expenses or emergencies. It reduces financial stress and provides peace of mind, knowing that you have control over your financial situation.

In conclusion, budgeting is a vital skill for teenagers to learn. It promotes financial literacy, helps you take control of your finances, develops good money management habits, and provides financial security. By mastering the art of budgeting at a young age, you set yourself up for a successful and prosperous financial future.

Setting Financial Goals for Teenagers

Setting Financial Goals for Teenagers

When it comes to budgeting, teenagers often have limited experience and financial literacy. However, it is crucial for them to start developing good money management habits early on. One effective way to do this is by setting financial goals.

Setting financial goals can help teenagers gain a sense of direction and purpose when it comes to their finances. It allows them to prioritize their spending and make informed decisions about where their money should go. By setting goals, teenagers can also learn valuable lessons about saving, budgeting, and the importance of delayed gratification.

Here are some steps teenagers can take to set their financial goals:

- 1. Identify their objectives: Encourage teenagers to think about what they want to achieve with their money. It could be saving for a specific item they desire or setting aside funds for college or a future trip.

- 2. Determine the timeline: Help teenagers establish a timeline for achieving their goals. This could be short-term, such as within a few months, or long-term, spanning several years.

- 3. Break it down: Teach teenagers to break down their goals into smaller, achievable milestones. This will make them feel more attainable and help track progress along the way.

- 4. Set realistic targets: Ensure teenagers set goals that are realistic and achievable within their current financial means. Unrealistic goals can lead to frustration and discourage further financial planning.

- 5. Create a budget: Assist teenagers in creating a budget that aligns with their goals. This will help them allocate their income effectively, ensuring they have enough money to meet their financial objectives.

- 6. Track and adjust: Encourage teenagers to regularly track their progress towards their goals. If necessary, they should be willing to make adjustments to their budget to stay on track.

By setting financial goals, teenagers can develop important skills that will serve them well throughout their lives. It is essential to emphasize the value of saving, budgeting, and making informed financial decisions. With practice and dedication, teenagers can become financially responsible individuals who are well-prepared for their future.

Creating a Budgeting Plan

Creating a Budgeting Plan

Budgeting is an essential skill for teenagers to learn as it helps them develop financial literacy and manage their money effectively. By creating a budgeting plan, teens can gain control over their finances and make informed decisions about saving, spending, and investing. Here are some steps to help you create a budgeting plan:

1. Set Financial Goals:

Start by setting clear financial goals. Determine what you want to achieve with your money, such as saving for college, buying a car, or going on a vacation. Having specific goals will give you a sense of direction and motivation for budgeting.

2. Track Your Income:

Begin by tracking your income sources, including allowances, part-time jobs, or any other money you receive. Make a note of how much money you earn each month, so you have a clear understanding of your total income.

3. Identify Your Expenses:

Next, identify your expenses by tracking your spending habits. Categorize your expenses into fixed (e.g., rent, phone bill) and variable (e.g., entertainment, dining out) expenses. Be sure to include all your expenses, no matter how small, to get a comprehensive view.

4. Differentiate Wants from Needs:

When reviewing your expenses, it’s important to differentiate wants from needs. Needs are essential items like food, clothing, and transportation, while wants are things you desire but can live without. Prioritize your needs and be mindful of your wants to avoid overspending.

5. Create a Budget:

Now that you have a clear understanding of your income and expenses, it’s time to create a budget. Start by allocating a portion of your income towards savings, ensuring you save at least 10-20% of your earnings. Then, allocate funds for your fixed expenses and set aside a reasonable amount for your variable expenses.

6. Stick to Your Budget:

Creating a budget is only beneficial if you follow it consistently. Make a habit of tracking your expenses regularly and compare them to your budget. Adjust your spending habits if necessary to ensure you stay within your budgetary limits.

7. Review and Adjust:

Periodically review your budget and make adjustments as needed. As your financial situation and goals change, you may need to reallocate funds or revise your budgeting plan. Regularly reviewing and adjusting your budget will help you stay on track and achieve your financial goals.

By following these steps and creating a budgeting plan, teenagers can develop good money management skills and establish a strong foundation for their financial future. Remember, budgeting is a valuable tool that empowers you to make smart financial decisions and achieve your desired financial goals.

Tracking Income and Expenses

p. Tracking Income and Expenses

Budgeting is an essential skill for teenagers to develop as it promotes financial literacy and helps them make informed decisions about their spending. One crucial aspect of budgeting is tracking income and expenses. By keeping a record of how much money is coming in and going out, teens can gain a better understanding of their financial situation and make adjustments accordingly.

To track income and expenses effectively, teens can use various methods. One option is to create a simple spreadsheet or use budgeting apps specifically designed for tracking finances. These tools can help teens categorize their income sources, such as allowance, part-time jobs, or money received as gifts. They can also record their expenses, including purchases, bills, and savings.

Using a spreadsheet or budgeting app allows teens to organize their income and expenses in a clear and structured manner. They can easily input the amounts and categorize them accordingly, making it simpler to analyze their spending patterns. By regularly updating the spreadsheet or app, teens can keep track of their financial progress and identify areas where they may need to cut back or save more.

Another effective way to track income and expenses is by keeping a written record. Teens can use a notebook or a journal to jot down their sources of income and daily expenses. This method may be more suitable for those who prefer a tangible and hands-on approach. By writing down their income and expenses, teens can visually see where their money is going and identify any unnecessary or excessive spending habits.

Regardless of the method chosen, consistency is key when tracking income and expenses. It is important for teens to make it a habit to record their financial activities regularly. Whether they do it daily, weekly, or monthly, maintaining a routine will ensure that no income or expense goes unnoticed.

Tracking income and expenses is an essential part of budgeting for teenagers. It allows them to have a better understanding of their financial situation and make informed decisions about their spending. By utilizing tools like spreadsheets or budgeting apps, or simply keeping a written record, teens can effectively track their income and expenses and work towards achieving their financial goals.

Making Smart Spending Choices

When it comes to budgeting, teenagers may find it challenging to make smart spending choices. However, developing this skill is crucial for financial literacy and long-term financial success. By understanding how to manage their money wisely, teenagers can avoid unnecessary debt and build a strong foundation for their future. Here are some tips to help teenagers make smart spending choices:

- Create a budget: Start by determining your sources of income, such as allowance or part-time jobs. Then, list all your expenses, including school supplies, entertainment, and personal items. Allocate a certain amount of money for each category and stick to it.

- Track your expenses: Keep a record of all your spending. This will help you identify where your money is going and determine if you’re overspending in certain areas. You can use a notebook, a budgeting app, or even an Excel spreadsheet.

- Think before you buy: Before making a purchase, ask yourself if it’s something you really need or just want. Avoid impulsive buying and take the time to consider the value and utility of the item.

- Comparison shop: When making big-ticket purchases, compare prices from different stores or online retailers. Look for sales, discounts, or coupons that can help you save money.

- Avoid peer pressure: It’s common for teenagers to feel pressured to buy things to fit in or impress their friends. Remember, true friends will accept you for who you are, not for what you own. Stick to your budget and make choices that align with your financial goals.

- Save for the future: Set aside a portion of your income for savings. It’s important to have an emergency fund and start saving for long-term goals, such as college or a car. Consider opening a savings account to keep your money separate from your regular spending.

- Be mindful of online purchases: Online shopping can be convenient, but it’s essential to be cautious. Only buy from reputable websites and be wary of sharing personal or financial information online.

- Learn to differentiate between needs and wants: Understanding the difference between essential items and luxuries is key to making smart spending choices. Prioritize your needs and allocate your money accordingly.

- Seek guidance: Don’t hesitate to ask for advice from parents, guardians, or other trusted adults. They can provide valuable insights and help you make informed decisions about your finances.

By following these tips, teenagers can develop good budgeting habits and make smart spending choices that will set them on a path to financial success.

Saving and Investing for the Future

When it comes to budgeting, teenagers often overlook the importance of saving and investing for the future. Developing good financial habits at a young age can have a significant impact on their long-term financial well-being. By understanding the basics of saving and investing, teenagers can set themselves up for a successful financial future.

Saving money is the first step towards financial security. It allows teenagers to build an emergency fund, save for short-term goals, and develop a strong financial foundation. A good rule of thumb is to aim to save at least 20% of your income or allowance. This money can be put into a savings account or a low-risk investment option like a certificate of deposit (CD).

Investing, on the other hand, involves putting your money into assets that have the potential to grow over time. While it may seem intimidating, investing can be a powerful tool for building wealth. It’s important to understand that investing comes with risks, and it’s crucial to do thorough research and seek guidance from professionals before making any investment decisions.

One popular investment option for teenagers is a retirement account, such as an Individual Retirement Account (IRA). By starting to save for retirement at a young age, teenagers can take advantage of compound interest and potentially build a substantial nest egg for their future. Additionally, investing in stocks or mutual funds can provide teenagers with an opportunity to grow their money over the long term.

- Start early: The power of compounding works best when you start investing early. The earlier you start, the more time your money has to grow.

- Set specific goals: Determine what you are saving and investing for. Whether it’s for college, a car, or retirement, having clear goals can help you stay motivated and focused.

- Diversify your investments: Spreading your investments across different asset classes can help reduce risk. Consider diversifying your portfolio by investing in stocks, bonds, and real estate.

- Stay informed: Keep up with financial news and trends to make informed investment decisions. Understanding the market and economy can help you make smarter investment choices.

- Seek professional advice: If you’re unsure about investing, consult with a financial advisor who can provide guidance tailored to your specific needs and goals.

Remember, saving and investing are long-term commitments. It’s important to stay disciplined and avoid making impulsive financial decisions. By developing good saving and investing habits early on, teenagers can create a solid foundation for their future financial success.

14 Replies to “Budgeting Basics for Teens”

As a parent, I found this article extremely helpful in teaching my teenager about budgeting. It breaks down the basics in a way that is easy to understand. I especially appreciated the tips on tracking expenses and setting financial goals. My daughter has started using a budgeting app recommended in the article and it has made a noticeable difference in her spending habits. Thank you for providing such practical advice!

I wish I had come across this article when I was a teenager! Learning about budgeting at a young age could have saved me so much trouble later on. These tips are spot-on and applicable to anyone, not just teens. I particularly liked the emphasis on distinguishing between needs and wants. It’s a crucial concept that many adults still struggle with. Great job on addressing this important topic!

I have a question regarding emergency funds. How much should a teenager set aside for unforeseen expenses? Should it be a fixed amount or a percentage of their income? I believe teaching teens about emergency savings is essential, but I’m not sure about the specifics. Can you provide some guidance on this aspect of budgeting for teens?

This article is a gem! Budgeting is a life skill that everyone should learn early on. I appreciate the practical examples given throughout the article, such as the ‘envelope system.’ It’s a great way to visually track spending and avoid overspending. I’ll definitely share this with my teenage niece who’s just starting to manage her own money. Keep up the excellent work!

I love how this article emphasizes the importance of budgeting as a tool for achieving financial goals. It’s all about creating good habits from an early age! I remember when I started budgeting in high school, and it really helped me save up for my first car. It would be great if the article could provide some additional resources or recommended books to further educate teens about personal finance.

I’ve been budgeting for a few months now, and it has made a huge difference in my spending habits. This article articulates the key principles of budgeting in a concise manner. I’d love to read more about strategies to resist impulse buying. It’s something I struggle with occasionally, and I believe many other teens do too. Do you have any tips specifically addressing this challenge?

I appreciate the emphasis on teaching teens about the importance of long-term financial planning. It’s crucial to start early and develop good saving habits. The section on setting financial goals was particularly helpful. I wonder if you could provide some real-life examples of financial goals that teens can set for themselves? It would help make the concept more relatable and inspiring.

This article is a fantastic resource for teens who want to take control of their finances. I love how it covers all the essential aspects of budgeting, from income tracking to expense categorization. The step-by-step approach makes it easy to follow and implement. I’ll be sharing this with my younger siblings who are just starting to earn their own money. Thank you for sharing these valuable insights!

I found the section on budgeting apps particularly interesting. It’s amazing how technology can simplify the budgeting process and make it more engaging for teens. I would love to see a follow-up article that reviews some popular budgeting apps targeted specifically at teenagers. It would help us make an informed decision when choosing the right app for ourselves or our kids.

As someone who struggled with finances in my early twenties, I wish I had learned about budgeting as a teen. This article provides a solid foundation for teens to start managing their money wisely. The tips on saving for college or future expenses are especially relevant. I’m sure many teenagers will find this article helpful in avoiding financial pitfalls later in life.

As a teenager, I wish I had learned about budgeting earlier. It would have saved me from a lot of financial mistakes. This article provides clear and practical tips for teens to start budgeting. I especially liked the advice on tracking expenses and setting financial goals. It’s never too early to learn about money management!

I stumbled upon this article while looking for ways to better manage my money. The budgeting tips mentioned here are fantastic! I’ve been struggling with overspending, but the idea of creating categories and allocating specific amounts to each expense seems really helpful. Can you provide more insights on how to prioritize savings while still enjoying teen life?

Budgeting is not something I was taught in school, but it’s an essential life skill. This article breaks it down in a way that’s easy to understand. I appreciate the emphasis on distinguishing between needs and wants. I’ve been guilty of impulse buying, and it’s time to change that habit. Are there any recommended budgeting apps or tools for teens?

Being a teenager, managing money can be quite overwhelming. I found this article really helpful in explaining the basics of budgeting. The tips on creating a realistic budget and saving for long-term goals were eye-opening. However, I’m curious about how to handle unexpected expenses that may arise. Any suggestions on building an emergency fund?