- Why Financial Literacy is Important for Teens

- Setting Financial Goals: How to Plan for the Future

- Managing Allowances and Part-time Earnings

- 1. Create a Budget

- 2. Track Spending

- 3. Set Financial Goals

- 4. Prioritize Saving

- 5. Make Informed Purchases

- Budgeting Basics: Making Every Penny Count

- Understanding Credit and Debt: A Teen’s Guide

- What is Credit?

- Types of Credit

- Understanding Debt

- Budgeting for Credit and Debt

- Saving and Investing: Building Wealth from a Young Age

Why Financial Literacy is Important for Teens

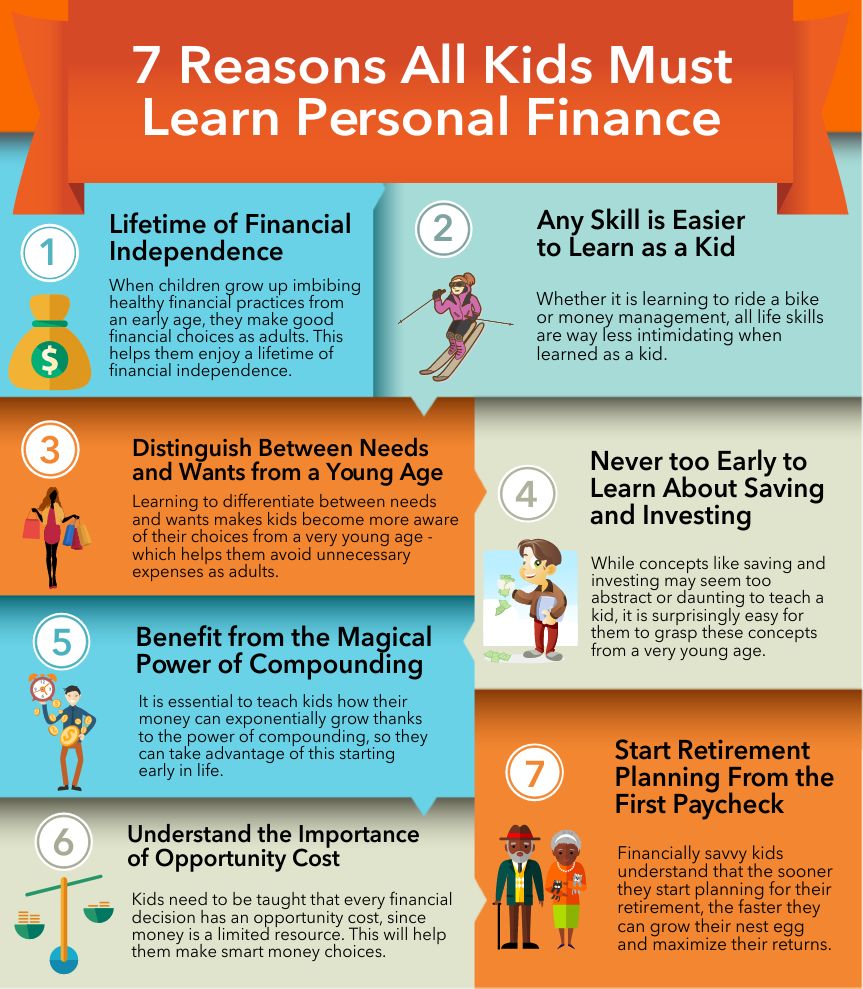

Financial literacy is a crucial skill for teenagers to develop as they transition into adulthood. Understanding how to manage money, create budgets, and make informed financial decisions lays a strong foundation for their future success. In this section, we will explore why financial literacy is important for teens and how it can benefit them in various aspects of their lives.

Firstly, financial literacy equips teenagers with the knowledge and skills necessary to make informed decisions about their personal finances. By learning about budgeting, saving, and investing, teens can develop a sense of financial responsibility and independence. They can learn to prioritize their expenses, set financial goals, and make thoughtful choices about how to allocate their money.

Moreover, financial literacy empowers teens to navigate the increasingly complex financial landscape they will encounter as they grow older. From credit cards and loans to mortgages and taxes, having a solid understanding of financial concepts and terminology enables them to make informed decisions and avoid common pitfalls. This knowledge also helps teens avoid falling into debt and build a strong credit history, which is essential for future financial endeavors such as buying a car or a home.

Furthermore, financial literacy fosters a sense of confidence and self-reliance in teenagers. When they have a good grasp of financial concepts, they are more likely to make sound financial decisions and avoid relying on others for financial support. This independence not only benefits them in their personal lives but also sets them up for success in their professional endeavors.

In addition, financial literacy promotes responsible money management and helps teens develop good financial habits from an early age. By learning how to save and invest wisely, teens can start building wealth and securing their financial future. This knowledge also encourages responsible spending habits, helping them avoid impulsive purchases and unnecessary debt.

Finally, financial literacy provides teenagers with the skills necessary to adapt and thrive in an ever-evolving economic landscape. As technology continues to shape the way we manage money, understanding concepts such as online banking, digital payments, and cybersecurity becomes increasingly important. By staying informed and up to date with financial trends and innovations, teens can position themselves for success in an increasingly digital world.

In conclusion, financial literacy is a vital skill for teenagers to develop. By learning about budgeting, saving, investing, and making informed financial decisions, teens can lay a strong foundation for their future financial success. It empowers them to navigate the complex financial landscape, fosters independence and confidence, promotes responsible money management, and equips them with the skills necessary to thrive in the digital age. Encouraging financial literacy among teenagers is crucial for their long-term financial well-being.

Setting Financial Goals: How to Plan for the Future

Setting Financial Goals: How to Plan for the Future

When it comes to financial literacy, teenagers often find themselves at a disadvantage. Learning about budgeting, saving, and setting financial goals can be overwhelming. However, with the right knowledge and planning, teenagers can take control of their financial future. In this section, we will explore the importance of setting financial goals and provide practical tips on how to plan for the future.

Setting financial goals is crucial for teenagers as it helps them develop good money management habits and provides a roadmap for their financial success. Whether it’s saving for a dream vacation, buying a car, or affording college tuition, having clear goals can keep you motivated and focused on achieving your desired financial outcomes.

To get started, here are some steps to help you effectively plan for your financial future:

1. Identify Your Financial Goals:

– Take some time to think about what you want to achieve financially in the short-term and long-term. Do you want to save for a specific purchase? Are you planning for higher education expenses? Knowing your goals will give you direction in your financial planning journey.

2. Prioritize Your Goals:

– Once you have identified your financial goals, prioritize them based on their importance and urgency. This will help you allocate your resources and efforts accordingly.

3. Set SMART Goals:

– SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. When setting your financial goals, make sure they are specific and clearly defined. For example, instead of saying “I want to save money,” set a goal like “I want to save $500 by the end of the year.” This makes it easier to track your progress and stay motivated.

4. Create a Budget:

– Budgeting is an essential skill for financial success. Start by tracking your income and expenses to get a clear picture of your current financial situation. Then, create a budget that aligns with your financial goals. Allocate your income towards savings, expenses, and any debt payments.

5. Save Regularly:

– Saving money regularly is key to achieving your financial goals. Set aside a portion of your income each month and make it a habit. Consider opening a separate savings account to keep your savings separate from your everyday spending.

6. Track Your Progress:

– Regularly monitor and evaluate your progress towards your financial goals. This will help you stay on track and make any necessary adjustments to your budget and savings plan.

7. Seek Professional Advice:

– If you’re unsure about how to plan for your financial future, consider seeking guidance from a financial advisor or a trusted adult who has experience in managing finances. They can provide valuable insights and help you make informed decisions.

Remember, setting financial goals and planning for the future is a continuous process. As you achieve one goal, set new ones to keep progressing. By developing good financial habits early on, you are setting yourself up for a brighter and more secure financial future.

Managing Allowances and Part-time Earnings

Managing Allowances and Part-time Earnings is a crucial aspect of financial literacy for teenagers. Learning how to effectively budget and make the most of their money is an essential skill that will serve them well throughout their lives. Here are some tips to help teens navigate their allowances and part-time earnings:

1. Create a Budget

One of the first steps in managing allowances and part-time earnings is to create a budget. A budget helps teens track their income and expenses, ensuring that they are not overspending and that their money is allocated wisely. Start by listing all sources of income, such as allowances and part-time job earnings. Then, identify the necessary expenses, such as school supplies or transportation costs. Finally, allocate a portion of the income for savings and discretionary spending.

2. Track Spending

Tracking spending is an important habit to develop. Encourage teens to keep a record of their expenses, either on paper or using budgeting apps or spreadsheets. By tracking their spending, teens can identify areas where they may be overspending and make necessary adjustments to stay within their budget. It also helps them become more conscious of their spending habits and make informed decisions about their purchases.

3. Set Financial Goals

Teens should learn to set financial goals to work towards. Whether it’s saving for a big-ticket item or planning for college, having goals gives teens a sense of purpose and helps them prioritize their spending. By saving a portion of their allowances and part-time earnings towards their goals, teens will develop good savings habits and learn the value of delayed gratification.

4. Prioritize Saving

Saving should be a top priority for teenagers. Encourage them to set aside a portion of their allowances and part-time earnings for savings. It’s essential to emphasize the importance of building an emergency fund for unexpected expenses. This will help them develop a safety net and avoid relying on credit cards or loans in times of financial need.

5. Make Informed Purchases

Teach teens the importance of making informed purchasing decisions. Encourage them to research and compare prices before making a purchase. Impulse buying can lead to overspending and regret later on. By practicing mindful spending, teenagers can make smarter choices with their money and stretch their allowances and part-time earnings further.

By following these tips, teenagers can develop good financial habits and gain control over their allowances and part-time earnings. Learning how to budget, track spending, save, and make informed purchases will set them on the path to financial success.

Budgeting Basics: Making Every Penny Count

When it comes to financial literacy, teenagers often find themselves facing new challenges and responsibilities. One essential skill that every teen should develop is budgeting. Learning to manage money effectively can make a significant impact on their financial well-being both now and in the future. In this section, we will explore the basics of budgeting and how to make every penny count.

Creating a budget allows you to have a clear understanding of your income and expenses. It helps you plan and prioritize your spending, ensuring that you have enough money for your needs and goals. Here are some steps to get started:

- Track your income: Begin by identifying all the sources of income you have. This could include allowances, part-time jobs, or money from odd jobs. Tracking your income will give you a clear picture of the money you have available.

- Identify your expenses: Take note of all your expenses, both fixed and variable. Fixed expenses are those that remain the same each month, such as rent, utilities, or loan payments. Variable expenses, on the other hand, can vary from month to month, such as entertainment, dining out, or shopping.

- Create spending categories: Group your expenses into categories like housing, transportation, food, entertainment, and savings. This will help you see where your money is going and identify areas where you can cut back if needed.

- Set financial goals: Determine what you want to achieve with your money. It could be saving for a new gadget, a future vacation, or building an emergency fund. Setting goals will give you a sense of purpose and motivation to stick to your budget.

- Allocate your income: Once you have a clear understanding of your income and expenses, allocate your money to each spending category. Make sure to prioritize essential expenses and savings before allocating money to discretionary spending.

- Track and adjust: Regularly track your spending to ensure you’re staying within your budget. If you find yourself overspending in certain categories, analyze your expenses and make adjustments accordingly. Consider finding ways to reduce costs or increase your income to meet your financial goals.

Remember, budgeting is a skill that takes time to develop. Be patient with yourself and don’t get discouraged if you make mistakes along the way. The key is to learn from those mistakes and make adjustments to improve your financial situation. By mastering the art of budgeting, you’ll be well on your way to making every penny count and achieving financial success in the long run.

Understanding Credit and Debt: A Teen’s Guide

Understanding Credit and Debt: A Teen’s Guide

When it comes to financial literacy, understanding credit and debt is essential for teenagers. Learning how to effectively manage your finances and make wise decisions can set you up for a successful future. In this guide, we will explore the basics of credit and debt, and provide you with the knowledge you need to navigate this important aspect of personal finance.

What is Credit?

Credit is a financial tool that allows you to borrow money or access goods and services with the promise of repayment in the future. It is important to understand that credit is not free money, but rather a loan that you must eventually repay.

When you use credit, you are essentially borrowing money from a lender, such as a bank or credit card company. The lender will provide you with a specific amount of money, known as a credit limit, that you can use for purchases. Keep in mind that you will need to pay back the borrowed amount, usually with interest.

Types of Credit

There are different types of credit that you may come across as a teenager:

- Credit Cards: These allow you to make purchases up to a certain limit. You will receive a monthly statement outlining your charges and the minimum amount you must pay.

- Student Loans: These are loans specifically designed to help students pay for their education. They typically have a lower interest rate and offer flexible repayment options.

- Personal Loans: These are loans that can be used for various purposes, such as buying a car or funding a vacation. They often come with fixed interest rates and monthly payments.

Understanding Debt

Debt is the amount of money you owe to lenders or creditors. It is the result of borrowing money or using credit to make purchases. While having some debt is not necessarily a bad thing, it is important to manage it responsibly.

When you borrow money, you enter into a legal agreement to repay the lender over a specific period of time. This includes paying back the principal amount borrowed as well as any interest or fees associated with the loan.

It’s crucial to remember that taking on too much debt or failing to make your payments on time can negatively impact your credit score. This can make it more difficult to secure future loans or credit in the long run.

Budgeting for Credit and Debt

One of the key components of managing credit and debt is budgeting. Creating a budget helps you track your income and expenses, ensuring that you have enough money to cover your debts and other financial obligations.

Start by listing all your sources of income, such as allowance, part-time job, or money from odd jobs. Then, make a list of your monthly expenses, including any debt payments and necessary expenses like food and transportation.

Compare your income to your expenses to determine if you have any surplus or if you need to make adjustments. If you find that you have more expenses than income, it may be necessary to cut back on non-essential spending or explore ways to increase your income.

By budgeting effectively, you can ensure that you are able to meet your financial obligations and maintain a healthy credit history.

Remember, financial literacy is a lifelong learning process. By understanding credit and debt as a teenager, you are taking a crucial step towards building a solid foundation for your future financial well-being.

Saving and Investing: Building Wealth from a Young Age

Saving and Investing: Building Wealth from a Young Age

In today’s fast-paced world, financial literacy is crucial for teenagers. Understanding how to manage money, save, and invest wisely can set them up for future success. One key aspect of financial literacy is learning about saving and investing from a young age. By developing good financial habits early on, teenagers can build wealth and secure a stable financial future.

Saving money is the foundation of financial success. It involves setting aside a portion of your income for future use. There are several strategies teenagers can employ to start saving. First, creating a budget is essential. A budget helps you track your income and expenses, allowing you to identify areas where you can save. It is important to prioritize saving by allocating a specific percentage of your income towards savings. This will help you develop discipline and ensure that saving becomes a regular habit.

Another effective way to save money is by cutting unnecessary expenses. It is easy to get caught up in the allure of instant gratification, but learning to distinguish between needs and wants is vital. By reducing discretionary spending, such as eating out or buying unnecessary items, teenagers can save a significant amount of money in the long run.

Once you have established a savings habit, it is essential to consider investing as a means of building wealth. Investing involves putting your money into various financial instruments with the goal of generating a return. While many people associate investing with the stock market, there are other options available to teenagers.

One investment option for teenagers is a high-yield savings account. These accounts offer higher interest rates than traditional savings accounts, allowing your money to grow at a faster rate. Another option is investing in low-risk mutual funds or exchange-traded funds (ETFs). These investment vehicles provide diversification and can be a great way to start building a portfolio.

It is important to note that investing carries risks, and teenagers should always do thorough research and seek guidance from a financial advisor or trusted adult before making any investment decisions. However, by starting to invest at a young age, teenagers can benefit from the power of compound interest and potentially see their wealth grow significantly over time.

In conclusion, financial literacy is essential for teenagers, and learning about saving and investing is a crucial component. By developing good saving habits, creating a budget, and reducing unnecessary expenses, teenagers can start building a solid financial foundation. Additionally, exploring different investment options, such as high-yield savings accounts or low-risk mutual funds, can help them grow their wealth over time. Remember, the key to financial success is starting early and staying disciplined.

5 Replies to “Finance 101 for Teens: A Beginner’s Guide to Financial Literacy”

I wish I had learned about finance when I was a teenager. It would have saved me from making a lot of financial mistakes in my early twenties. This article is a great resource for teens to understand the basics of financial literacy. I particularly liked the section on budgeting. It’s important for young people to learn how to manage their money wisely from an early age.

As a teenager who has recently started working part-time, this article provided me with valuable insights into financial literacy. I didn’t realize the importance of saving and investing until I read this guide. I have already started creating a budget and setting aside some money for my future goals. However, I would love to learn more about different investment options suitable for teens. Can you provide more information on that?

Financial literacy is a crucial life skill that often gets overlooked in traditional education. I appreciate this beginner’s guide for teens as it breaks down complex financial concepts into simple terms. The section on credit cards and debt management was eye-opening. I wish someone had explained these things to me earlier. The article mentions the importance of building credit, but how can teens start building credit without a credit history? Any tips?

This article is a great starting point for teens to develop a strong foundation in financial literacy. I found the section on financial goals particularly useful. It’s essential for young people to have clear goals and understand how their financial decisions align with those goals. I would love to see some real-life examples or case studies illustrating how financial literacy can positively impact a teenager’s life. It would make the concepts more relatable and practical.

I’m a parent, and I believe it’s crucial for teenagers to learn about financial literacy. This article provides an excellent overview of the key concepts. However, I think it would be helpful to include some tips on how parents can support their teens in developing good financial habits. As a parent, I want to ensure that I am doing my part in preparing my child for a financially secure future. Can you provide some guidance in that aspect?